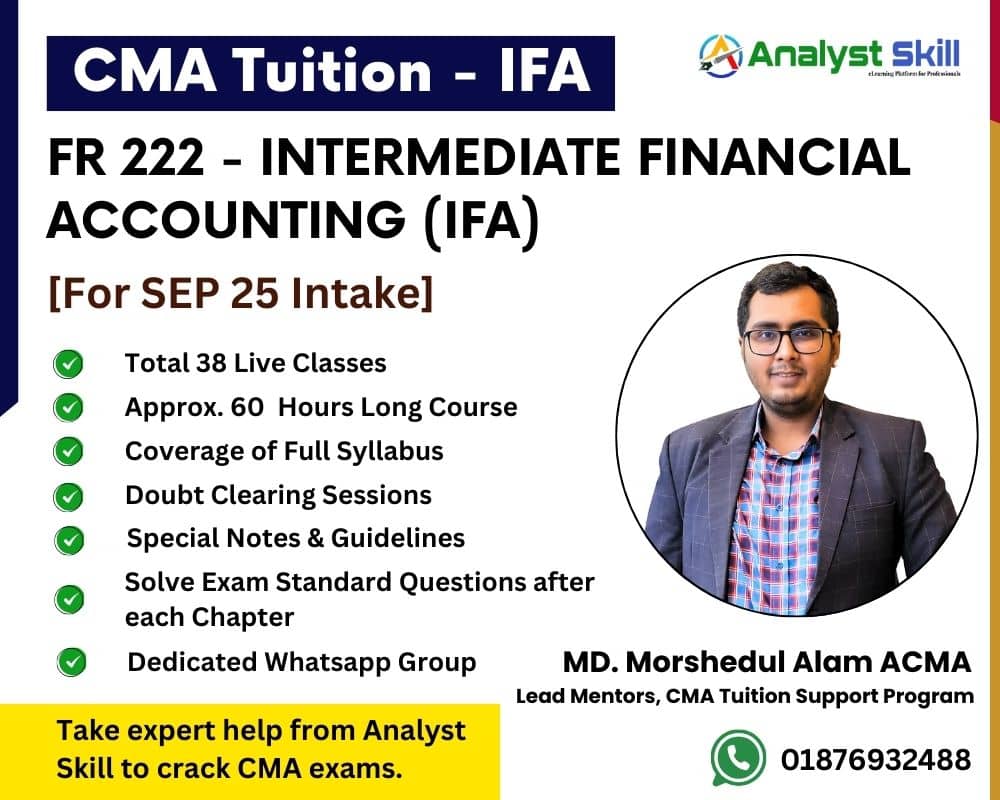

The FR 222 – Intermediate Financial

Accounting Tuition Support Program is designed to provide a comprehensive

understanding of cost accounting for CMA (ICMAB) candidates who will sit for

the exam in Sep 2024. The entire course is divided into several chapters

covering various topics.

This comprehensive course consists of a minimum of 30 live classes, totaling

over 50 hours of instruction, ensuring students receive thorough coverage of

the subject matter. If additional class is required to complete the course,

extra schedule will be declared, and classes will be taken accordingly.

This course is designed to provide students with a comprehensive understanding

of intermediate financial accounting principles and practices. Throughout the

course, we will explore various topics including financial reporting standards,

conceptual frameworks, ethical issues, and the preparation and analysis of

financial statements.

The course begins with an introduction to financial reporting, covering the

regulatory framework, international financial reporting standards (IFRS), and

the role of standard-setting bodies. We will then delve into the conceptual

framework of financial reporting, discussing its objectives, qualitative

characteristics, and ethical considerations. We will also explore the reporting

of current assets, current liabilities, inventories, property, plant, and

equipment, intangibles, leases, and non-current liabilities.

Additionally, the course will cover financial instruments, revenue recognition,

accounting for taxation, and the preparation of financial statements including

the income statement, statement of financial position, statement of changes in

equity, and cash flow statement. Throughout the course, students will gain

practical skills in applying accounting standards to CMA exams and techniques

to pass this subject.

Course Synopsis

<!--[if !supportLists]-->1.

<!--[endif]-->Live

Classes 1 to 6: Foundations of Financial Reporting

Classes 1 and 2 introduce financial

reporting, regulatory frameworks, and standard-setting bodies. We explore the

conceptual framework, its objectives, qualitative characteristics, and ethical

considerations. Classes 3 to 6 focus

on reporting financial performance, covering income statements, comprehensive

income, and other aspects such as earnings per share.

<!--[if !supportLists]-->2.

<!--[endif]-->Live

Classes 7 to 13: Assets and Liabilities Reporting

These classes cover reporting current

assets, liabilities, inventories, property, plant, equipment, intangible

assets, leases, non-current liabilities, and financial instruments.

<!--[if !supportLists]-->3.

<!--[endif]-->Live

Classes 14 to 20: Specialized Reporting Topics

We discuss specific reporting standards

including revenue recognition (IFRS 15), taxation (IAS 12), and the preparation

of financial statements.

<!--[if !supportLists]-->4.

<!--[endif]-->Live

Classes 21 to 30: Application and Analysis

The final classes focus on applying

learned principles to real-world scenarios, revenue recognition, taxation, and

cash flow statement preparation.

In accordance, this course provides a

comprehensive understanding of intermediate financial accounting principles and

practices, enabling students to prepare, interpret, and analyze financial

statements in accordance with IFRS to prepare you pass the FR 222 –

Intermediate Financial Accounting (IFA).

Throughout the course, there will be

revision sessions and practice exercises to reinforce learning and help you

excel in the CMA exam. Finally, there will be two 100 marks tests to be taken

online.

What will i learn?

- Prepare effectively for the CMA (ICMAB) exam with comprehensive coverage of the syllabus.

- Participate in revision sessions, practice exercises, and two 100 marks online tests to excel in the exam.

- Understand the conceptual framework and ethical issues in financial reporting.

- Apply IFRS & IAS in Financial Statements Preparation.

- Interpret reporting standards for financial performance and other information.

- Analyze and report current assets and liabilities, including inventory management (IAS 2).

- Learn the treatments of property, plant, and equipment (IAS 16).

- Understand the treatment of intangible assets and leases (IFRS 16).

- Learn the treatments of non-current liabilities and financial instruments.

- Apply IFRS 15 for revenue recognition from contracts with customers.

- Understand the accounting treatment of taxation (IAS 12).

- Learn to prepare financial statements according to IFRS and IAS guidelines.

- Learn to prepare and interpret cash flow statements (IAS 7).

- knowledge of accounting principles is required

- Access to a computer with a stable internet connection.

- Willingness to actively participate in live classes and complete assigned coursework.

- For recorded classes, access to a device capable of playing video content is necessary.

- Regular attendance and participation in class discussions and activities are highly encouraged.

- Willingness and dedication to pass the CMA exam.

- This is not a certificate course. Hence, no certificate will be provided after completion of this course.

Course Reviews & Ratings(3.67 Out of 5.00)

To stay connect with us and get regular updates, follow our official Facebook page and join our groups:

Write a public review