This comprehensive Financial Management course spans over 65 hours and is designed to equip students with both the fundamental and advanced knowledge necessary to pass the CMA EF 232 - Financial Management and EF 343 - Corporate Finance Strategy and Financial Markets subjects.

The course begins with an Introduction to Financial Management, covering the objectives, functions, and decision-making processes fundamental to the discipline. It then delves into the Time Value of Money and Risk & Return, where students learn about present and future value calculations and the relationship between risk and return

The course extensively covers the Valuation of Securities over five parts, focusing on various valuation techniques for stocks and bonds, including dividend discount models and the practical applications of valuation. In Financial Statements Analysis, students need to learn how to analyze financial statements and key financial ratios to interpret the financial health of an organization. The Capital Budgeting module introduces principles and techniques for evaluating capital projects, including risk analysis.

Further, the course examines the Cost of Capital, explaining how to determine the cost of debt and equity, and compute the weighted average cost of capital (WACC). The concepts of Operating and Financial Leverage and their impact on earnings are discussed, followed by an exploration of Capital Structure, where students learn about optimal capital structures and relevant theories.

The Financing Decisions module provides insights into debt and equity financing options, their advantages, and disadvantages, along with lease financing types and their financial evaluations. The course also addresses Dividend Policy, exploring factors influencing dividend decisions and their impact on firm value.

Strategic aspects are covered in Theory, Planning, and Financing, which involves financial planning and control within a strategic management context. Working Capital Management focuses on managing cash, marketable securities, and receivables, ensuring liquidity and effective credit policies. Finally, the course concludes with Financial Management in International Operations, where students learn about the complexities of financial management on a global scale, including exchange rate risk management and international financing decisions.

What will i learn?

- Knowledge of Finance is recommended but not mandatory.

- Access to a computer with a stable internet connection.

- Willingness to actively participate in live classes and complete assigned coursework.

- For recorded classes, access to a device capable of playing video content is necessary.

- Regular attendance and participation in class discussions and activities are highly encouraged.

- Willingness and dedication to pass the CMA exam.

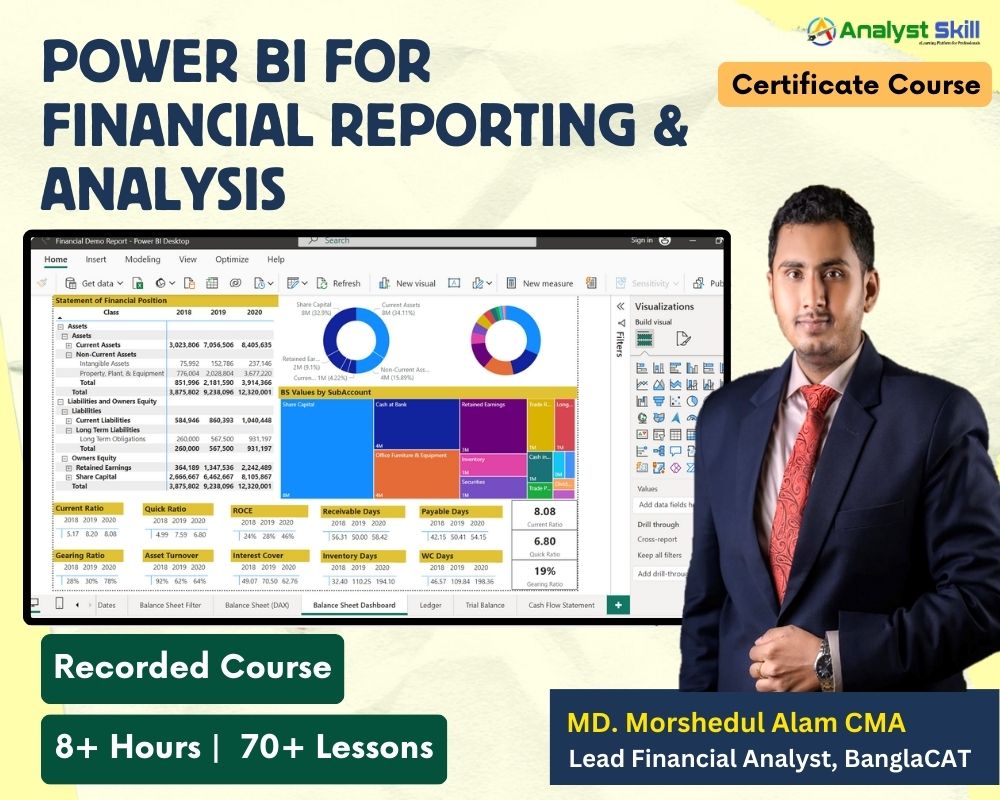

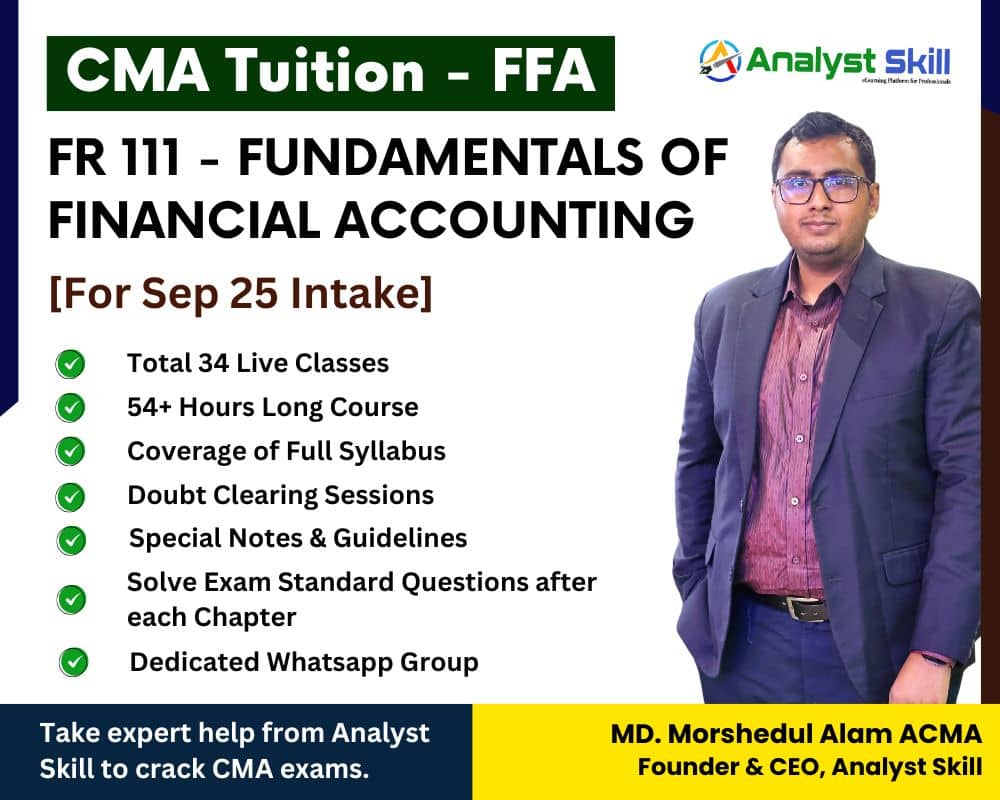

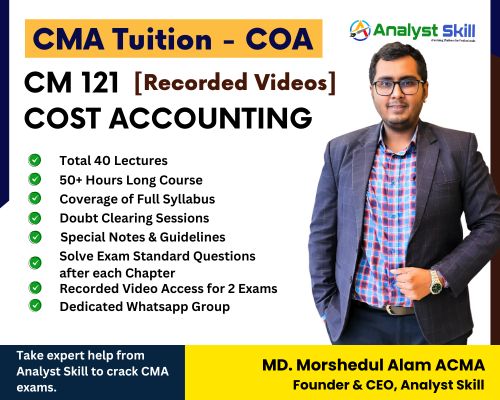

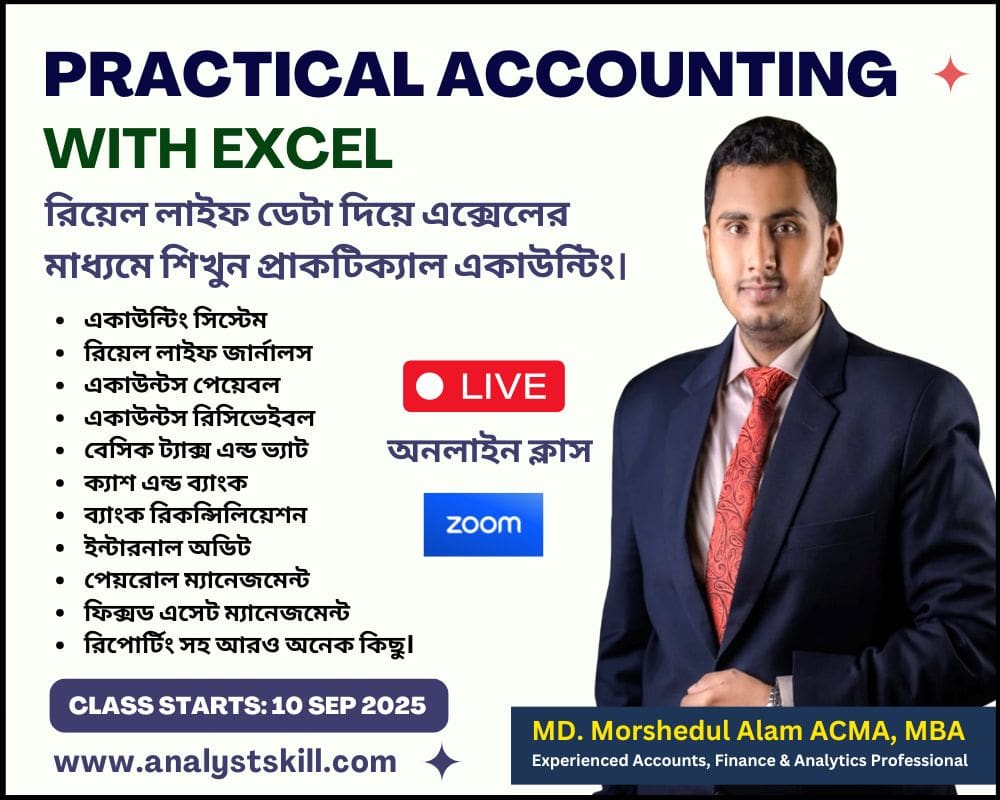

MD. Morshedul Alam ACMA

Corporate professional with more than 8 years of experience in costing, cash flow planning, budgeting, financial reporting, internal auditing and business analytics. He is a qualified Cost and Management Accountant (CMA) from ICMAB. He has adequate knowledge of advance excel and Power BI to formulate complex financial models, dashboards and analytics. Also, he is founder and chief content creator of Analyst Skill.

IAS IFRS Financial Modeling Financial Reporting Costing Cost Control Budgeting Financial Analysis Excel Power BI AnalyticsCourse Reviews & Ratings(4.5 Out of 5.00)

To stay connect with us and get regular updates, follow our official Facebook page and join our groups:

Write a public review