This comprehensive course is divided into two main sections: Management Reporting in Excel and Financial Statements Preparation under IFRS standards. Participants will learn essential techniques to build and automate financial reports, analyze results, and prepare IFRS-compliant financial statements, providing valuable insights for organizational decision-making.

Section A: Management Reporting in Excel covers foundational and advanced Excel techniques to facilitate effective financial reporting. This section begins with the allocation of expenses from the General Ledger to divisions, establishing a clear financial overview by division. Participants will then learn to model an automated Profit & Loss (P&L) report from scratch, enabling accurate, time-saving reporting. Emphasis is placed on comparing monthly, yearly, month-to-date (MTD), and year-to-date (YTD) results against budgets to assess performance comprehensively.

In addition to modeling, participants will conduct break-even analysis and prepare detailed budget variance reports. These skills will support the analysis of budget variances, helping to pinpoint discrepancies and their root causes. The course also covers the preparation of summary reports, optimized for management review, and product- and division-wise Gross Profit (GP) analysis to evaluate the financial health of different business segments.

Section B: Financial Statements Preparation provides a structured approach to IFRS-compliant financial reporting. It begins with an overview of financial statements and GL mapping to ensure alignment with IFRS standards. Participants will engage in calculating Cost of Goods Sold (COGS) and valuing ending inventories, followed by determining current and deferred tax. This section also covers asset management, including the calculation of Property, Plant, and Equipment (PP&E), intangible assets, and Work in Progress (WIP) construction schedules.

Following this, participants will learn to prepare each major financial statement: the Statement of Financial Performance, Statement of Financial Position, Statement of Cash Flows, and Statement of Changes in Equity. This includes creating comprehensive notes to the financial statements, detailing significant accounting policies and meeting IFRS disclosure requirements. The course also covers compliance with regulatory bodies such as RJSC, BSEC, and BIDA, ensuring all statements adhere to relevant standards.

Finally, the course addresses Tax and VAT issues as they relate to financial statements and provides best practices for handling the external audit process, including documentation and responses. This curriculum equips finance professionals with the technical and regulatory knowledge to excel in financial reporting and management analysis, supporting accurate and insightful decision-making.

What will i learn?

- Build a solid understanding on the Basics of Microsoft Excel.

- Basic knowledge of accounting

- Basic Excel Knowledge

- Basic Business Knowledge

- Internet Connection

- Willingness to Learn Financial Reporting

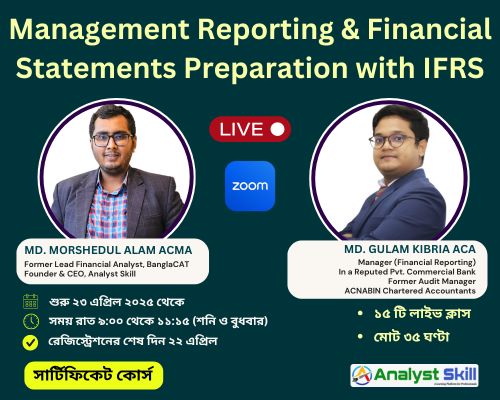

MD. Morshedul Alam ACMA

Corporate professional with more than 7 years of experience in costing, cash flow planning, budgeting, financial reporting, internal auditing and business analytics. He is a qualified Cost and Management Accountant (CMA) from ICMAB. He has adequate knowledge of advance excel and Power BI to formulate complex financial models, dashboards and analytics. Also, he is founder and chief content creator of Analyst Skill.

IAS IFRS Financial Modeling Financial Reporting Costing Cost Control Budgeting Financial Analysis Excel Power BI AnalyticsMd. Gulam Kibria ACA

Md. Gulam Kibria is an Associate Chartered Accountant (ACA) from The Institute of Chartered Accountants of Bangladesh (ICAB). He has completed his articledship from ACNABIN Chartered Accountants (Baker Tilly Bangladesh) in Bangladesh. He pursued his BBA in Finance from the University of Dhaka.

IAS IFRS ISA Financial Reporting Auditing Taxation VAT FRC RegulationCourse Reviews & Ratings(5 Out of 5.00)

To stay connect with us and get regular updates, follow our official Facebook page and join our groups:

Write a public review